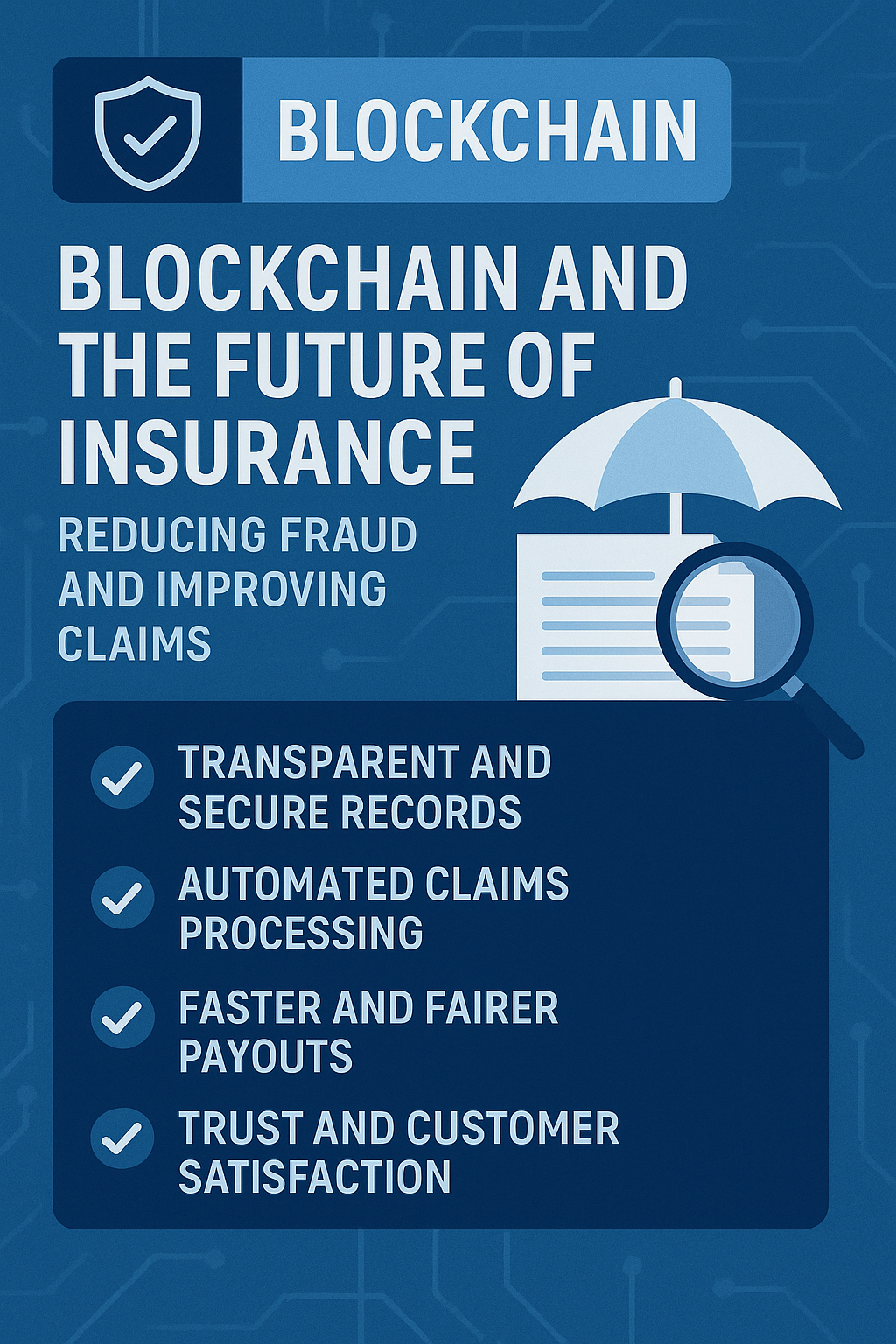

Blockchain and the Future of Insurance: Reducing Fraud and Improving Claims,

Flutter Bees Relax and earn rewards! Tap your stress away in the Flutter Bees clicker game or defend the hive to boost your mood. Every tap helps complete tasks and earn points.

Blockchain and the Future of Insurance: Reducing Fraud and Improving Claims

The insurance industry is undergoing a digital transformation, and blockchain is at the forefront of this change. Traditional insurance processes are often slow, opaque, and vulnerable to fraud. Blockchain technology offers a powerful solution by introducing transparency, security, and automation to the entire insurance value chain.

One of the major issues in insurance is fraud—false claims, duplicate claims, or forged documentation. Blockchain’s decentralized ledger records every transaction immutably, making it nearly impossible to alter or fake data. Insurers can access real-time, verified information across a secure, shared platform, drastically reducing fraud risk.

Another game-changing benefit is automated claims processing. Smart contracts, a feature of blockchain, can trigger claim payments automatically once pre-defined conditions are met. This removes delays and human error from the process, resulting in faster and fairer payouts for policyholders.

Transparency builds trust between insurers and customers. Policyholders can view all interactions and updates on a transparent ledger, reducing disputes and improving customer satisfaction.

Don’t forget to take breaks while reading—play Flutter Bees, the Telegram mini-game that helps you relieve stress and focus better

In addition, blockchain enables better collaboration between insurers, reinsurers, and regulatory bodies, streamlining data exchange and improving risk assessment.

As the technology matures, blockchain is set to revolutionize insurance by making it more secure, efficient, and user-friendly.

Flutter Bees Reset your brain and boost your day with a fun tapping game that helps reduce stress.

Post Comment